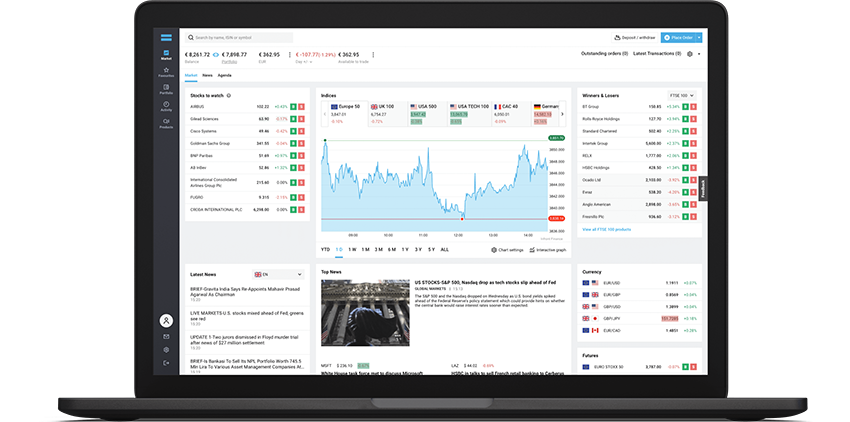

Simple is beautiful to DEGIRO, as evidenced by its trading platform. It is accessible via browser-based online and mobile platforms with an emphasis on simplicity and functionality. The UI is intuitive, uncomplicated, and simple to use.

TradersUnion’s experts have reviewed the Degiro trading platform deeply. You can check out their Degiro Review on their site.

Table of Contents

DEGIRO WebTrader

DEGIRO WebTrader is equipped with all the fundamental elements of an optimal trading platform. The developers have prioritized enhancing the trading experience by integrating design elements. The trader has a clear picture of his portfolio and transaction list, as well as market news and real-time updates.

Broker DEGIRO has done an excellent job protecting the data and privacy of users. It includes built-in security features such as two-factor authentication and facial ID verification. However, the platform’s developers omitted price notifications, the most fundamental necessity for live trading. Although it includes various charting capabilities, customizing options are restricted.

DEGIRO Mobile App

Like WebTrader, the Degiro Mobile App enables easy access to the user’s portfolio and transaction lists. They can also receive real-time market updates. The application is user-friendly and practical. However, it appears somewhat old. There are no customization options available.

Markets Available

For the convenience of its customers, DEGIRO offers a comprehensive range of market instruments. The investment opportunity comprises asset classes such as stocks, bonds, futures, options, mutual funds, exchange-traded funds, and investment trusts.

Although DEGIRO does not provide its customers with access to forex, CFDs, or cryptocurrencies, the company makes up for this shortcoming by giving customers access to more than 5000 EFTs. DEGIRO offers investors the opportunity to buy shares on 32 global stock exchanges, including in Europe, Oceania, Asia, and North America.

If you are interested in paper trading, you should check “Best Trading App” by Traders Union.

Structure of Compensation

DEGIRO has gained a reputation for providing the lowest rates on the market (up to 80% less than rival brokers). As a bargain broker, its pricing is highly competitive.

The maximum transaction fee is £5.00, and the trader must pay £1.75 plus 0.014 percent. The cost per share for trading on U.S. stock exchanges is only €0.50 plus $0.004 (USD). The fee structure differs between instruments.

Trading fees and non-trading fees are the two most common forms of costs that brokers charge their clients.

Trading Fees

Examples of trading fees include broker commissions, financing rates, conversion fees, and spreads. These costs are assessed whenever the client trades assets.

Non-Trading Fees

Fees not associated with trading have nothing to do with trading in and of themselves. The costs related to activities other than trading include, among other things, withdrawal fees, inactivity fees, and deposit fees.

DEGIRO allows its customers to make free deposits and withdrawals from their trading accounts. When you first create an account with DEGIRO, you will not be required to make a minimum initial deposit. There are no fees associated with withdrawals, but there is a charge for currency conversion if the base currency and the currency being withdrawn are not the same. Even though DEGIRO’s price structure does not include any costs for inactivity, the broker may recommend that the customer close his account in this circumstance.

Non-Commercial Fees

DEGIRO levies connectivity fees for international trading. For instance, a trader residing in the United Kingdom is exempt from trading fees on the London Stock Exchange (LSE).

The trader must pay €2.5 annually as an exchange connection charge, regardless of the volume of trades, if he purchases shares from other brokers outside his home market, such as the New York Stock Exchange.

Our Verdict

DEGIRO WebTrader has all the essentials of a trading platform. Designers have prioritized improving the trading experience. The trader can see his portfolio, transaction list, and real-time market news. Degiro Mobile App gives users convenient access to their portfolios and transaction listings, like WebTrader. Real-time market updates are available. User-friendly and functional, but dated. There’s no personalization.

DEGIRO offers clients many market instruments. Equities, bonds, futures, options, mutual funds, ETFs, and investment trusts are offered. DEGIRO’s rates are up to 80% lower than rival brokers’. Its pricing is competitive as a bargain broker. Trading fees include commissions, conversion fees, and spreads. Clients pay these fees when trading assets.